Scalable. Expandable. Multiple trading options.

It has always been a topic in question about where MarginX is heading, especially within a crowded perpetuals DEX market. What are the advantages of MarginX? Or, rather, what is the main difference between MarginX and these other DEXes?

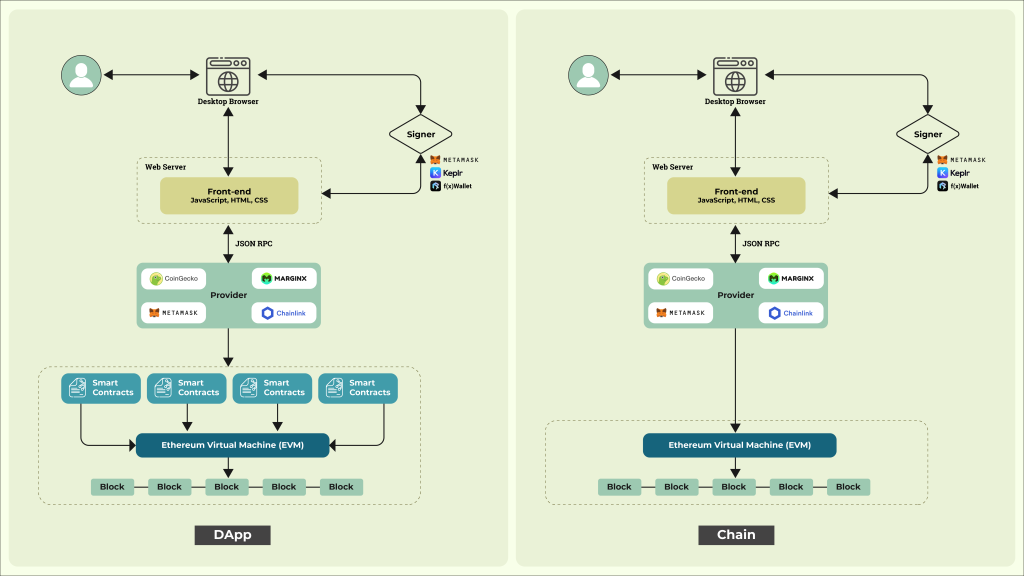

Technical Advantage: Chain VS DApp

From a structural point of view, MarginX is a standalone blockchain (or DApp chain), while many other DEXes are DApps. A simple analogy: MarginX is like Osmosis (on Cosmos), while the other DEX DApps are like AMMs.

MarginX is a layer 2 blockchain built on the Function X network. This way, it acts as a DApp chain instead of a DApp. The mechanics of MarginX’s operations, logic and actuation (deposit/withdrawal, open/close position, matching, liquidation etc.) are very different from how a DApp works.

For example, when you trade on dYdX, the transaction speed and transaction count are dependent on the traffic of the native chain. Imagine, if the TPS of Ethereum is only 12, the maximum number of transactions Ethereum can process in an hour is only 720. This bandwidth needs to be shared among other protocols, and the matching on a DApp level incurs very high gas fees. In addition, your trade has the potential of being front run (no thanks to those MEV bots).

There is also doubt on the transparency of the DEX because users are basically trading against smart contracts and a bunch of APIs — no one knows who the counterparty is, except for the protocol owners, and the price oracle is controlled by these same owners.

Simply put, the ceiling of a DApp is dependent on the bandwidth of the native chain.

Let’s assume the following:

- TPS of native chain: 50

- Usage of the bandwidth of the DApp: 50%

- Trading volume per request: $100

In this case, the total number of requests (including market order, limit order, open/close position, liquidation etc.) that can be processed annually is around 788 million. The annual total trading volume would be around $78.8 billion, which is less than 0.1% of the total trading volume of Binance.

On the other hand, the MarginX chain only deals with MarginX related transactions — no gas fee war, no shared bandwidth and no front runs. Being a dedicated DEX chain, requests are being processed on the blockchain ledger level to ensure transparency. Other than that, participants can set up validator nodes to participate in the block validation process as part of a decentralized governance model, and to speed up the broadcast process (no hidden advantages).

In a nutshell, the strength of a DEX chain compared with a DApp is the fully unleashed potential of a perpetuals trading platform — the processing capability could be 100x larger with full transparency, while maintaining an undisturbed and smooth traffic flow with significantly low gas fees. You wouldn’t want to open or close a position in a volatile market when the network is congested with massive traffic!

Other than the technical advantages, MarginX aims to provide multiple trading options, with a highly liquid trading environment to suit different preferences.

More Trading Options and Liquidity

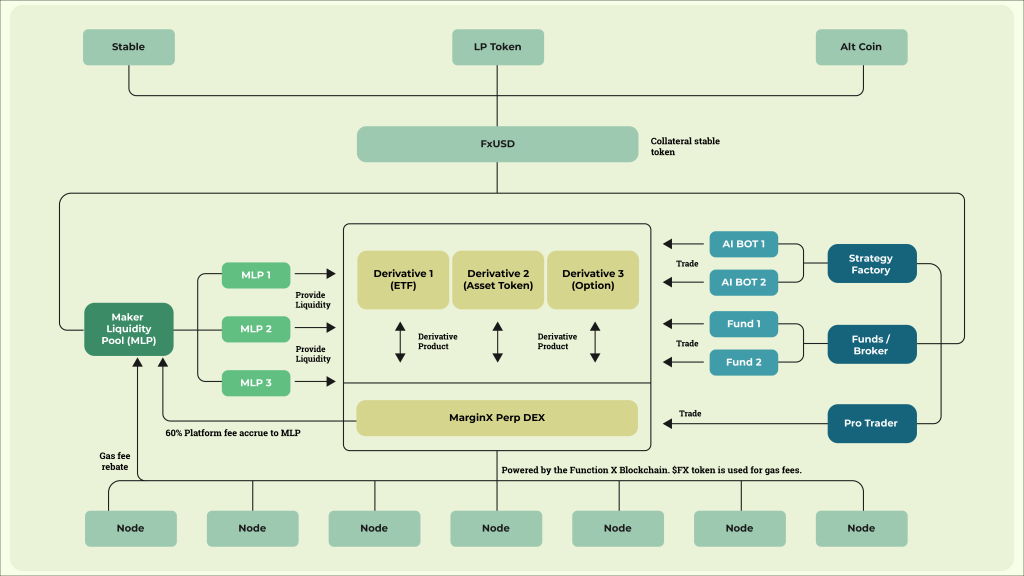

MarginX makes trading more versatile. Users can choose to either manage trading themselves or participate in MarginX Liquidity Pools — Maker Liquidity Pool (Banker), AI Bots Trading Pool (Player) or ETFs — to let the professionals manage their trading for them.

It will be as easy as social trading or trading mutual funds on a CEX, except that the mechanics on MarginX will be much more transparent.

Enhancement of Capital Efficiency

MarginX aims to enhance the capital efficiency of each user’s inflow and outflow.

Inflow: users can collateral their idle funds to trade

Outflow: users can tokenize their positions on MarginX

On MarginX, users will be allowed to collateral their idle funds (existing tokens or LP tokens) into an “fxUSD” token against a certain ratio, and using this token will be able to participate in several trading options provided by MarginX.

Besides this, MarginX will also allow users to tokenize their long/short positions on MarginX for extra liquidity. For example, if Alice opens a 3x BTC long position, she can either choose to keep that position or tokenize her 3x long position and trade on other platforms, or use the leveraged token as collateral to borrow funds, for hedging, or for other purposes.

Roadmap

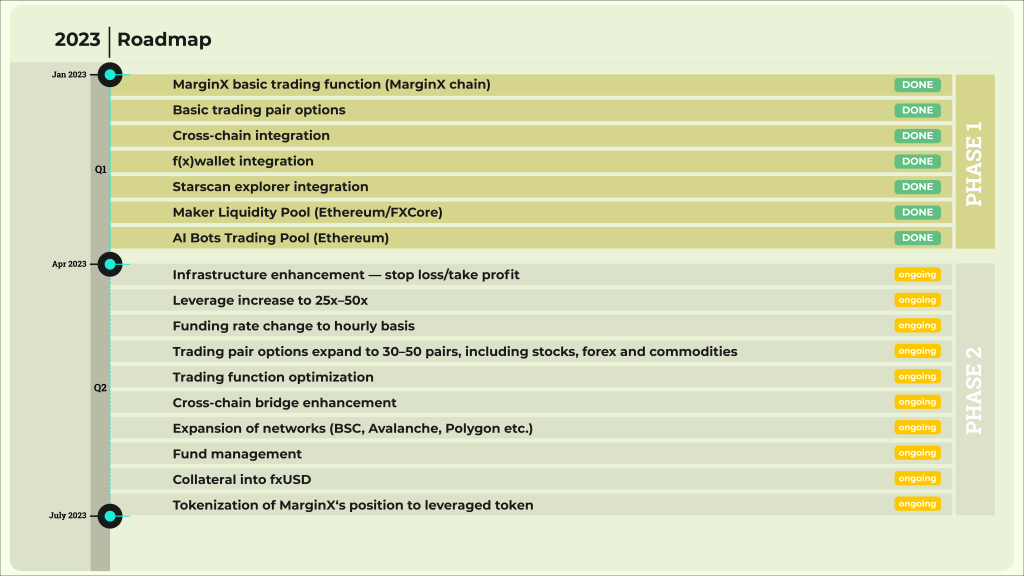

Phase 1 — 2023 Q1 (Complete)

- MarginX basic trading function (MarginX chain)

- Basic trading pair options

- Cross-chain integration

- f(x)wallet integration

- StarScan explorer integration

- Maker Liquidity Pool (Ethereum/FXCore)

- AI Bots Trading Pool (Ethereum)

Phase 2 — 2023 Q2 (Ongoing)

- Infrastructure enhancement — stop-loss/take-profit

- Leverage increase to 25x–50x

- Funding rate change to hourly basis

- Trading pair options expand to 30–50 pairs, including stocks, forex and commodities

- Trading function optimization

- Cross-chain bridge enhancement

- Expansion of networks (BSC, Avalanche, Polygon etc.)

- Fund management

- Collateral into fxUSD

- Tokenization of MarginX‘s position to leveraged token

The road ahead is exciting. Beyond a DEX, beyond a blockchain.

MarginX aims to become a comprehensive DeFi solution to further enhance idle liquidity while maintaining transparency.

Lastly, always Do Your Own Research (DYOR). Your principal is not guaranteed.

Danny

Core Contributor of MarginX